2026 Guide to Company Formation in Dubai World Trade Centre (DWTC)

Published Date:

Jan 5, 2026

Last Updated:

Jan 5, 2026

Inaugurated in 2016, the Dubai World Trade Centre (DWTC) is one of the recent additions to one of the most business-friendly free zones in the city. Strategically located in the heart of Dubai’s commercial hub, it has now evolved into one of the ideal choices for startups, SMEs, and large companies aspiring to expand in both local and international markets.

This blog will provide a comprehensive guide to company formation in DWTC, including the application process, requirements, costs, renewals, amendments, liquidation, and more.

What makes DWTC one of the most popular free zones in Dubai?

DWTC provides a unique, well-regulated, and highly desirable proposition for businesses seeking a competitive, attractive business ecosystem. It is home to 1,800 small and medium businesses, offering opportunities to build meaningful networks and access local, regional, and international markets.

Some of their notable benefits that make it a popular and most sought-after free zone in Dubai are as follows:

100% foreign ownership

0% taxes and customs duties

streamlined procedures for visas and permits,

Full capital and profit repatriation

Access to 1,200+ licensed business activities

Prime central business district location

Flexible office solutions

Set up and eServices support

Besides these benefits, DWTC is also the preferred choice for entrepreneurs from high-risk nationalities as it allows the prospect of obtaining a resident visa based on pre-approval.

The most competitive business hubs combine strong infrastructure with intelligent ecosystems, enabling companies not only to operate, but to thrive. Over the years, the Dubai World Trade Centre (DWTC) Free Zone has evolved into such an environment, recognised for its creativity, diversity, and its ability to unite industries around a shared vision of progress.

Jad Bechara, Acting Vice President of Asset Management, DWTC

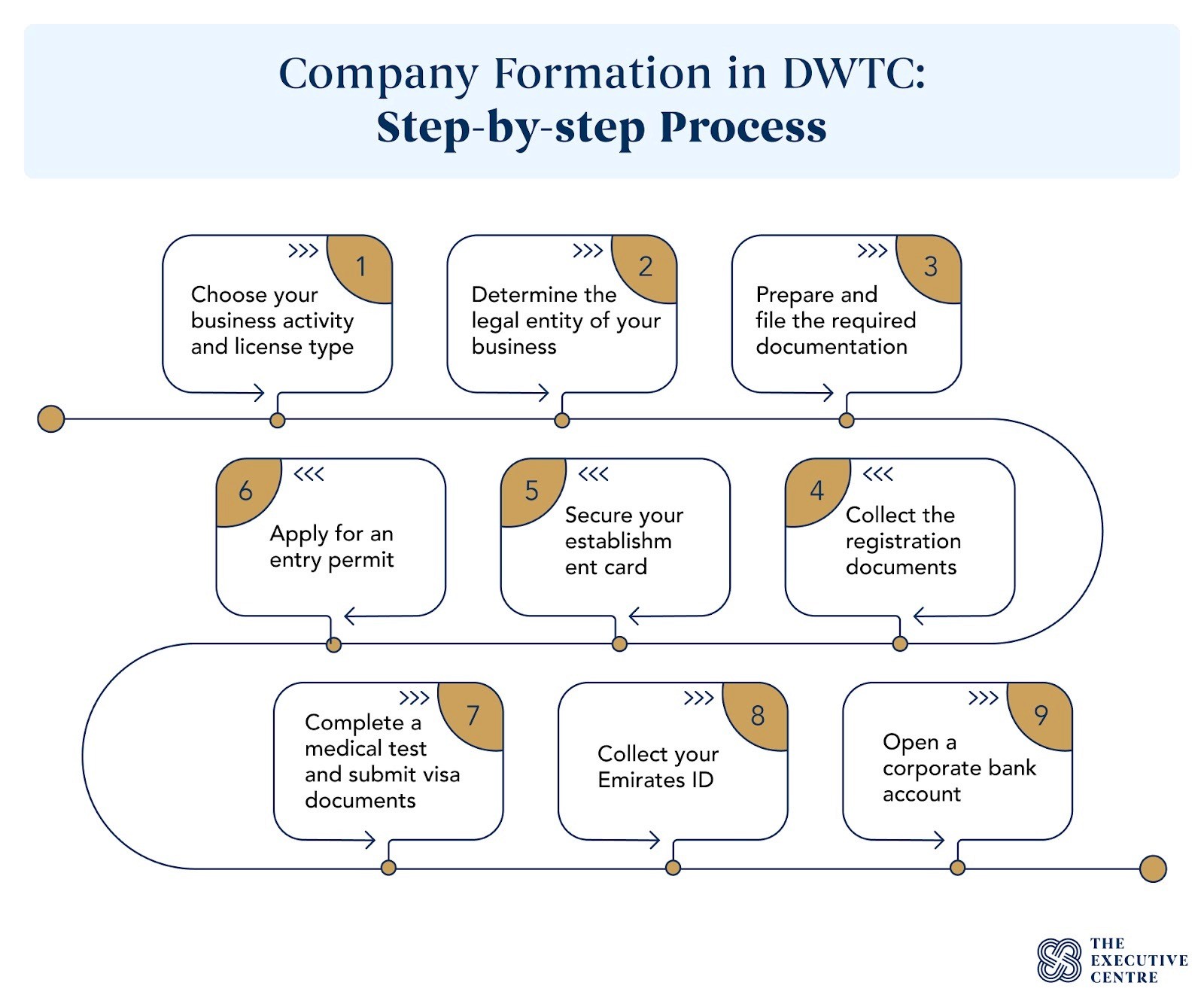

What are the steps for company formation in DWTC?

The company set up in the Dubai World Trade Centre Free Zone is managed by the DWTC Authority and usually takes about 3-4 working weeks. To start the application process, you will need to prepare a set of documents, pay the specified fees, obtain permits, and sign the assigned legal documents.

The setup process can even be completed remotely without shareholders being physically present in Dubai. However, in some cases, you will need to visit the country to complete visa formalities, account opening, and medical checkups.

1. Choose your business activity and license type

To start off, understand the type of trade licenses offered by DWTC that suits you. This step is crucial, as making the wrong or confused decision regarding business activities, the registration authority, or location can result in errors and delays during the application process. It can also create complications with opening a bank account or even invalidate the setup altogether legally.

2. Determine the legal entity of your business

DWTC offers many types of structures for establishing a business, depending on the preferred number of shareholders and business activities:

FZE (Free Zone Establishment): This is an LLC (Limited Liability Company) with a single shareholder, who can be either an individual or a non-individual (company).

FZCO (Free Zone Company): It is a type of free zone LLC created by multiple shareholders, which may include both individuals and non-individuals (companies).

Branch: Another legal structure that allows a parent company to open a branch within DWTC, retaining 100% ownership and subject to the parent company's name and activities. Parent companies can be both foreign and UAE-based.

3. Prepare and file the required documentation

Prepare, collect, and submit the documents requested by the free zone authority, along with a completed application. To obtain the initial approval for company registration, you will need to submit the following documents:

Passport copy

CV with your professional background

Short business plan describing your activity

Once you receive the first approval, you will then have to submit some other documentation, such as:

Specimen signature of a general manager

Memorandum and Articles of Association

Bank certificate for the deposit of share capital

Board resolution

In this step, you will also have to pay the required registration and processing fees.

4 . Collect the registration documents

You will receive the license and registration documents for the company, which are as follows:

MoA/AoA (Memorandum or Articles of Association)

Business license

Lease agreement

Certificate of Incorporation

If you require any additional documents, such as a Certificate of Incumbency or Certificate of Good Standing, an additional fee of AED 3,000 per document will apply.

5. Secure your establishment card

Receive the establishment card with detailed information about your company and visa quotes.

6. Apply for an entry permit

Then apply for an entry permit. If you are living outside the UAE, you will need to be in the country for processing and for the document to be issued within 60 days to complete the medical test and biometrics for your visa. If you are in the UAE when the entry permit is issued, your tourist or residency visa will be changed to the new one.

7. Complete a medical test and submit visa documents

You will then need to undergo a medical examination and submit the required documents for a residence visa. Depending on the type of registration package, the number of visas available for employees and owners may vary. It is important to remember that when applying for a residence visa, medical insurance is mandatory for both employees and the owner.

8 . Collect your Emirates ID

When the visa is issued, receive your Emirates ID card.

9 . Open a bank account

As the final step, open a corporate bank account. The time taken for approval varies and in some cases may take up to a month. Once the process is complete, you can then start running the business.

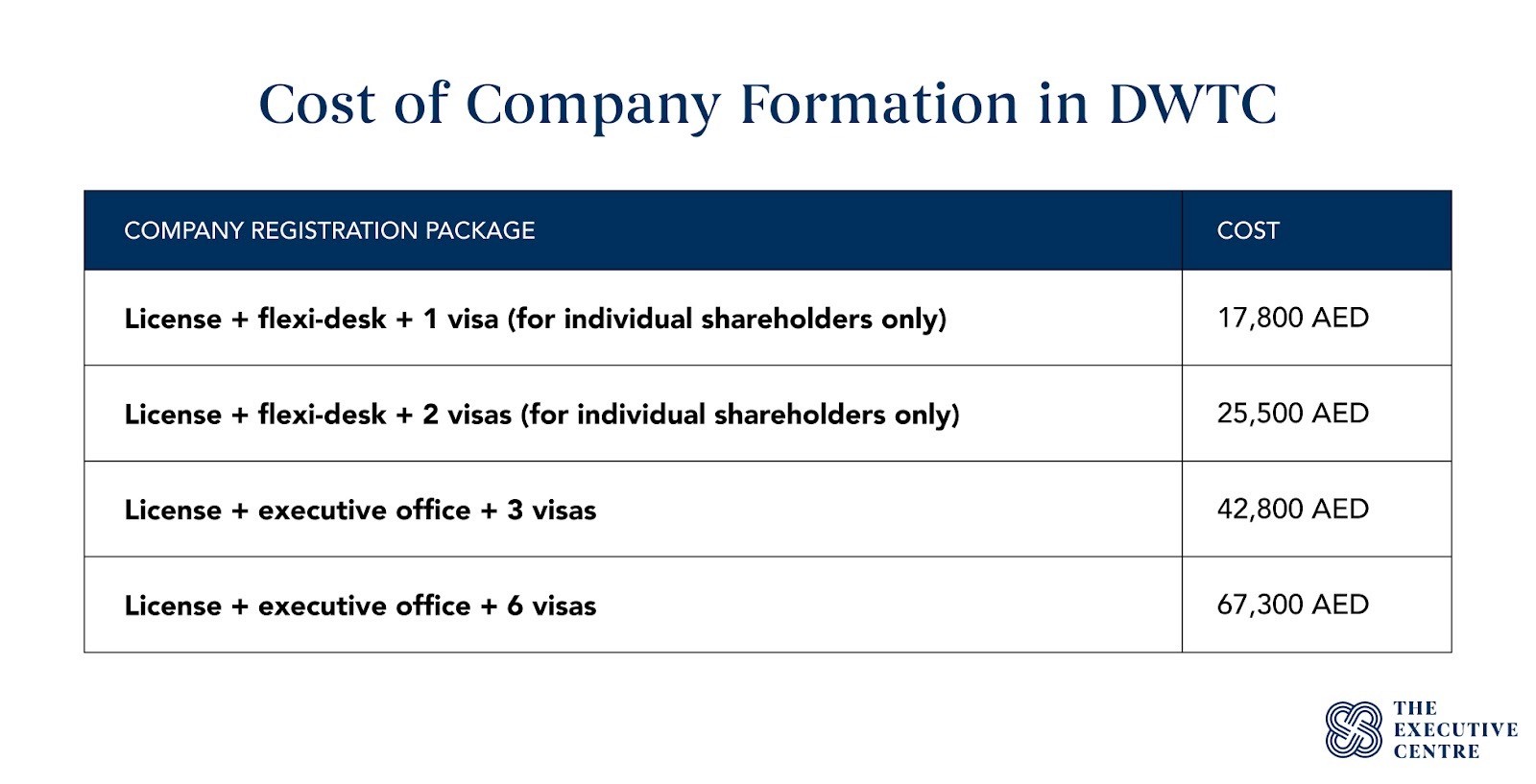

How much does it cost to set up a company in DWTC?

One of the main reasons DWTC is considered an ideal free zone is its affordability. It offers four packages for anyone looking to set up a company at DWTC.

The minimum physical space requirement for a general trading license is an executive office. It also requires an additional 12,000 AED per year. The packages mentioned above exclude visa charges, car parking, and the one-time, refundable security deposit of AED 3,500.

Is DWTC suitable for your business?

A DWTC company setup will be the best option for the following:

If you have recently formed a promising startup or SME and are hoping to expand locally or tap into regional or global markets.

If your preferred business activities involve trading, consultancy, or other professional services.

If you are looking for a cost-effective business setup solution with fewer documentation requirements, DWTC is an ideal choice. It is one of the most affordable free zones, offering a variety of package solutions, including flexi-desks.

If you prefer your business to be strategically located in a prestigious business hub, such as the World Trade Centre area, with high-end infrastructure and strong networking opportunities.

If you or your employees come from countries categorised as “high-risk” (e.g., Iran, Syria, Lebanon, Algeria, Turkey, etc.). It increases the success rate of obtaining a resident visa based on pre-approval or opening a bank account.

What licenses and business activities are allowed in DWTC?

DWTC supports a broad range of business activities across trading, services, and consultancy. However, they do not cater to any industrial activities.

One of the unique features of this free zone is that it allows up to 10 business activities under a single license, provided they belong to the same category or industry. Any business wishing to add additional categories of activities under the same license must pay an additional 1,500 AED.

Here is a list of business licenses supported by DWTC:

IT Services Licence

Audit & Accounting Licence

Commercial Trading Licence

Professional Services Licence

Project Management Licence

Consultancy Licence

Oil Trading Licence

Cafeteria Licence

Forex Trading Licence

Cryptocurrency Trading Licence (Dubai Crypto Licence)

E-commerce Licence

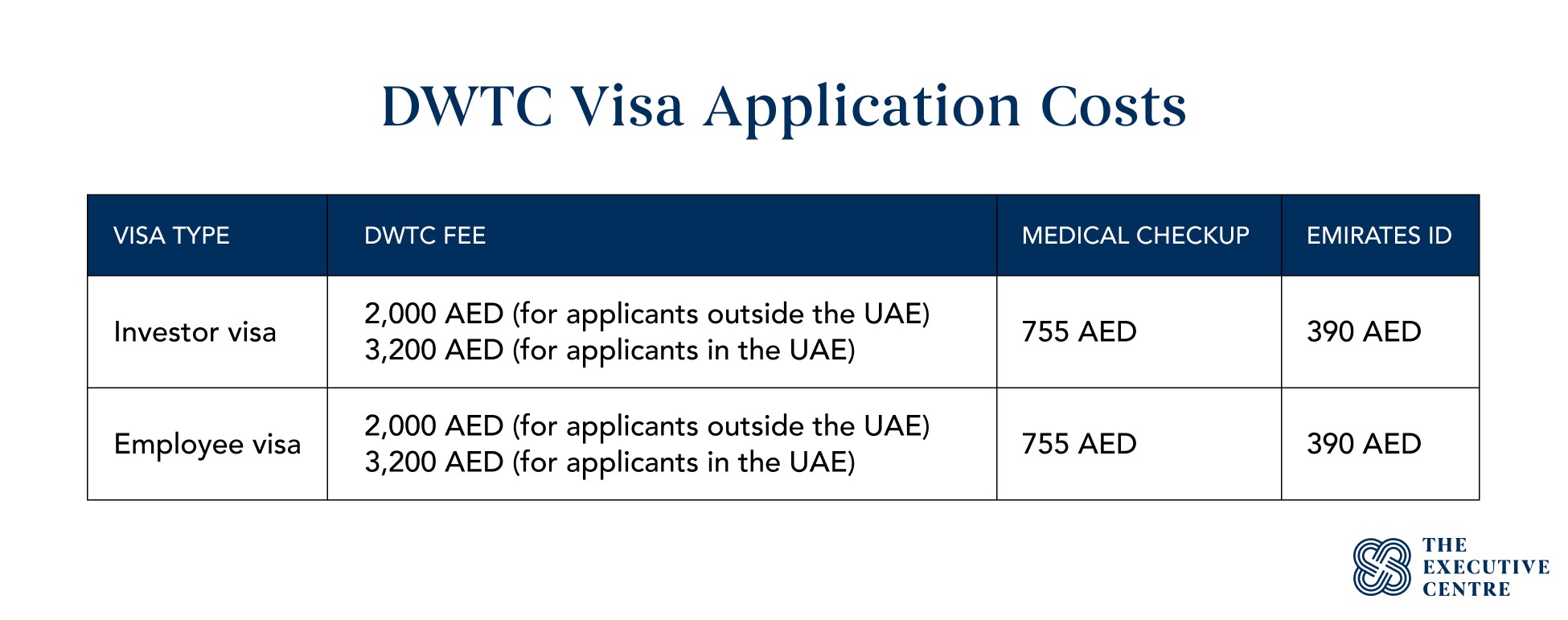

How does the residence visa work at DWTC?

As with other free zones in the UAE, DWTC also grants eligibility for a resident visa. The number of quotas available depends on the type of company and the size of the office selected, where (1) Flexi-desk: up to 2 visas, and (2) Executive office: up to 6 visas.

Investor visas are available for shareholders who hold more than 50% of the company shares. All visas are valid for 2 years.

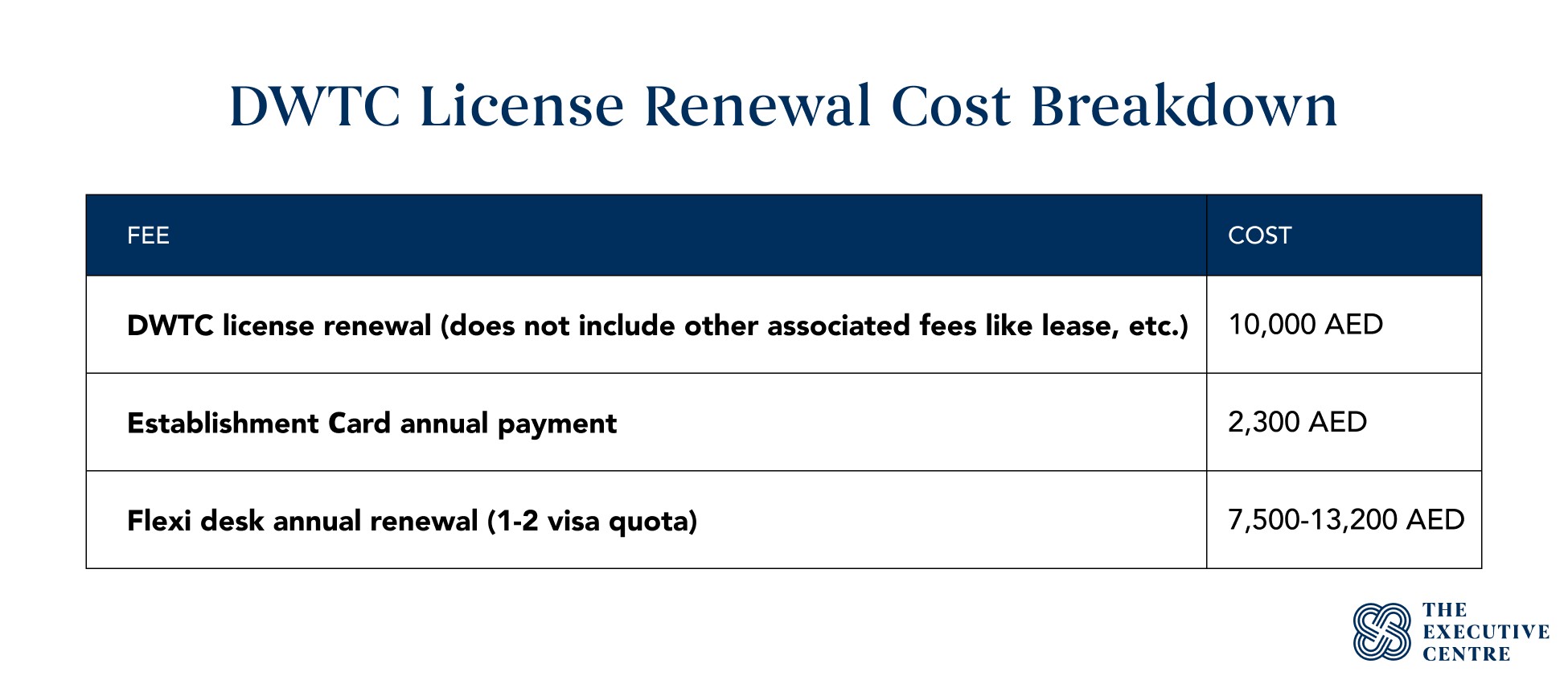

How often should the DWTC license be renewed, and what is the cost?

The company license should be renewed one year after registration. The process involves renewing both the license and the office lease. You will need to pay the license fees, establishment card costs, and office (facility) fees.

DWTC does not require an audit for license renewal. If your company has registered for VAT, you will need to produce a tax registration certificate to the free zone when renewing the company license.

What amendments can be made to a DWTC company?

You can make any amendments to your business in DWTC once the license is issued. Some of the most frequently requested amendments by businesses include changes to the trade name, activity, manager, or share transfer.

The price of each amendment varies, and once it is completed, the DWTC authority will need to issue a new license reflecting the amended information.

How to liquidate a company in DWTC?

If you want to close the company at DWTC, you will need to return the original documents and pay a liquidation fee of AED 3,000 (license de-registration).

The liquidation process includes the following steps:

1. Provide the following mandatory documents

Deregistration documentation

Business license and all other company incorporation documents

Bank account clearance and closure letter

Notarised, attested special resolution signed by the shareholders, clearly mentioning the reason for the liquidation

Clearance from the DWTC finance department

Clearance from DU and Etisalat

2. Then you will have to pay the cancellation fees and settle other payments to initiate the process.

3. You will also have to cancel all the residence visas and other immigration-related documents issued by the company.

4. Once the liquidation process is complete, you will be notified and receive the relevant documents.

5. For liquidation, you will also have to post a newspaper publication about the company closure in any of the UAE national newspapers.

Once everything is submitted, deregistration will be done in a few days.

Key Takeaways

DWTC stands out for its strategic location, diverse licensing options, and business-friendly regulations. It brings together global brands and growing enterprises within a single commercial district, offering clarity, speed, and flexibility at every stage. For companies prioritising reputation, accessibility, and operational ease, this free zone continues to set a strong benchmark.

Industry Insights

Professional Development

Written by:

Ketan Trehan

Regional Director - Middle East

Frequently Asked Questions

Do free zone companies need to pay VAT?

VAT applies when a company’s taxable turnover within the UAE exceeds AED 375,000. Sales made outside the UAE are generally exempt, but goods or services supplied locally attract the standard 5% VAT.

Are there any other taxes to be paid?

The UAE has no personal income tax. A 5% import duty applies to goods, and UAE Corporate Tax is 9% on taxable income above the threshold. Free zone companies may benefit from 0% Corporate Tax if they meet FTA conditions and remain compliant.

Can I open a bank account remotely?

No. Under UAE law, as per the Central Bank, a person is required to be present in the country to open a bank account. This is to verify the client’s identity. Some banks may allow remote account opening using digital applications or platforms.

Can a free zone company have offices outside the free zone?

Legally, the office of a company should be established in the free zone in which it is registered. However, if you need an office in Dubai, you can rent a space in a reliable business centre and use it on a flexible basis. This does not cancel the minimum required space (Flexi desk) for the freezone setup.